does tennessee have inheritance tax

All inheritance are exempt in the State of Tennessee. Tennessees tax exemption schedule is as follows.

Historical Tennessee Tax Policy Information Ballotpedia

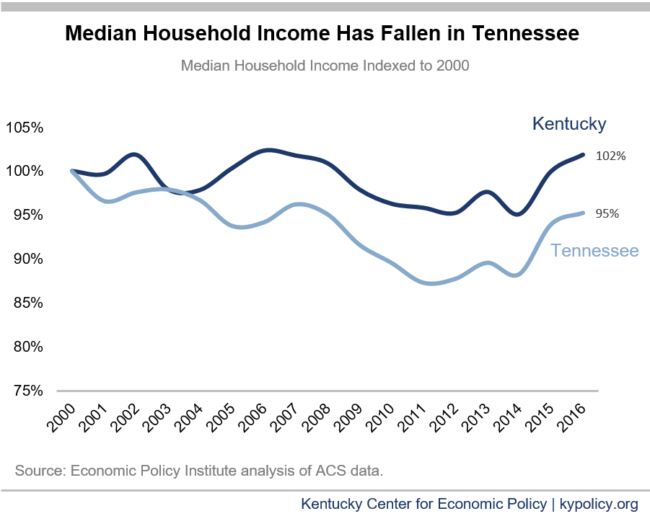

For example the neighboring state of Kentucky does have an inheritance tax.

. What is the state of Tennessee inheritance tax rate. An estate tax is a. For any decedents who passed away after January 1 2016 the inheritance tax no longer applies to their estates.

Only seven states impose and inheritance tax. However if the value of the estate is over the exempted allowance for a particular year the tax rate ranges from 55 at the lowest end to 95 at its highest end. What Tennessee called an inheritance tax was really a state estate taxthat is a tax imposed only when the total value of an estate exceeds a certain value.

Unlike estate taxes inheritance tax exemptions apply to the size of the gift rather than the size of the estate. What is the inheritance tax rate in Tennessee. Technically Tennessee residents dont have to pay the inheritance tax.

State inheritance tax rates range from 1 up to 16. You could potentially be liable for three types of taxes if youve received a bequest from a friend or relative who has died. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706.

IT-17 - Inheritance Tax -. The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is completely eliminated in 2016. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply.

IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Tennessee Resident. Any amount gifted to one person over that limit counts against your lifetime gift tax exemption of 1118 million. For any decedents who passed away after January 1 2016 the inheritance tax no longer applies to their estates.

Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. An inheritance tax is a tax on the property you receive from the decedent. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706.

IT-16 - No Beneficiary Classes for Inheritance Tax. Tennessee does not have an inheritance tax either. No estate tax or inheritance tax.

Under Tennessee law the tax kicked in if your estate all the property you own at your death had a. For example if your father-in-law from Tennessee a no-inheritance-tax state leaves you 50000 and you live in say New Jersey a state with an inheritance tax exemption threshold of 25000 for children-in-law that wouldnt be considered income and you would be free to enjoy the inheritance without worrying about taxes. There are NO Tennessee Inheritance Tax.

It also reduces your federal estate tax exemption. As of December 31 2015 the inheritance tax was eliminated in Tennessee. For any estate that is valued under the exemption.

However it applies only to the estate physically located and transferred within the state between Tennessee residents. Kentucky for instance has an inheritance tax that applies to all property in the state even if the person inheriting it lives elsewhere. It means that even if you are a Tennessee resident but have an estate in Kentucky your heirs will be.

The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax. IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Non-Tennessee Resident. Tennessee does not have an inheritance tax either.

The inheritance tax is levied on an estate when a person passes away. A capital gains tax is a tax on the proceeds that come from the sale of property you may have received. It has no inheritance tax nor does it have a gift tax.

There is a chance though that another states inheritance tax will apply if you inherit something from someone who lives in that state. The Federal estate tax only affects02 of Estates. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax.

It is possible though for Tennessee residence to be subject to an inheritance tax in another state. An inheritance tax a capital gains tax and an estate tax. Even though this is good news its not really that surprising.

All inheritance are exempt in the State of Tennessee. An inheritance tax is levied upon an individuals estate at death or upon the assets transferred from the decedents estate to their heirs. Until this estate tax is phased out the minimum tax rate for estates larger than the exemption amount is.

For example if a Tennessee resident receives in Heritance from someone who died in Pennsylvania they can. IT-15 - Inheritance Tax Exemption for Non-Tennessee Resident. Year Amount Exempted.

For all other estates subject to the inheritance tax for deaths that occurred before December 31 2015 the inheritance tax is paid by the executor administrator or trustee and it. The Federal estate tax only affects02 of Estates. Surviving spouses are always exempt.

Under Tennessee law the tax kicked in if your estate all the property you own at your death had a. There are NO Tennessee Inheritance Tax. For example the neighboring state of Kentucky does have an inheritance tax.

Tennessee Estate Tax Everything You Need To Know Smartasset

Tennessee State Economic Profile Rich States Poor States

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Market Inheritance Tax Retirement Strategies Tax

Graceful Aging Legal Services Pllc

Tennessee Estate Tax Everything You Need To Know Smartasset

2013 2022 Form Tn Rv F1400301 Fill Online Printable Fillable Blank Pdffiller

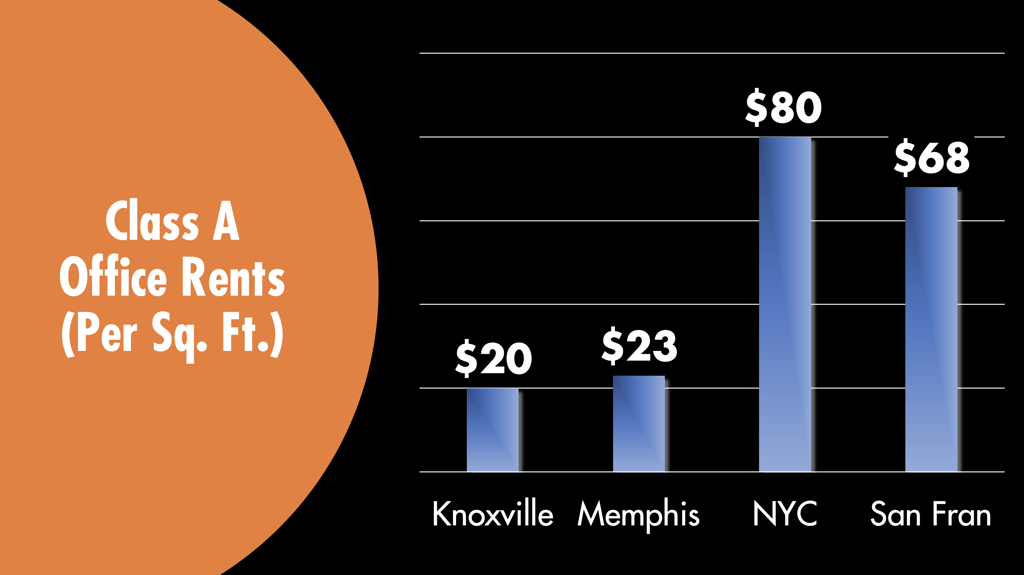

The Pros And Cons Of Locating Your Business In Tennessee

Tennessee Estate Tax Everything You Need To Know Smartasset

Economy Of Tennessee Wikipedia

Do You Need A Tax Id Number When The Trust Grantor Dies Probate When Someone Dies Last Will And Testament

Tennessee Last Will And Testament Template Download Printable Pdf Templateroller

What You Need To Know About Tennessee Will Laws Probate Advance

Tennessee Retirement Tax Friendliness Smartasset

Tennessee Health Legal And End Of Life Resources Everplans

Tennessee Retirement Tax Friendliness Smartasset

Shifting To A Tennessee Like Tax System Would Harm Kentucky Kentucky Center For Economic Policy

Divorce Laws In Tennessee 2022 Guide Survive Divorce

How To Get A Marriage License In Tennessee Zola Expert Wedding Advice